Caseblocks launches unified claims automation platform, bringing resilience to insurers

Media release, Caseblocks, October 19, 2020

Caseblocks launches a digital claims platform

No one anticipated the disruption of COVID-19. It has challenged every insurers ability to deliver. With work-from-home (WFH) arrangements extended to all functions, resilience requires a solid end-to-end digital process across the customer journey. That’s why we’re so excited to reveal our new improved platform, configurable claims templates, UX and integration capabilities. Each enhancement is designed to accelerate transformation and create a robust digital claims process from FNoL to settlement.

The power of a unified claims platform: speed and savings

Many insurance companies continue to use legacy systems and multiple claims processes for different business lines which are heavily reliant on manual procedures. This complexity often results in lengthy turn around times, data inconsistencies, lack of transparency and fraudulent claims. To improve customer experience and reduce benefit leakage, Caseblocks offers a unified claims platform capable of handling claims across Health and General business lines, integrated to multiple policy administration systems.

Unifying all claims processes onto a single platform, Caseblocks centralises the entire claims process. Content and data is captured from any source reducing manual input and enhancing customer experience, with faster turnaround for claims processing.

To make retrieving and interacting with data more efficient, we’ve wrapped our REST API into GraphQL, a sophisticated way of assembling disparate data on the server in just one call. One call, and the server does all the work, resulting in performance improvements which translate directly into faster processes.

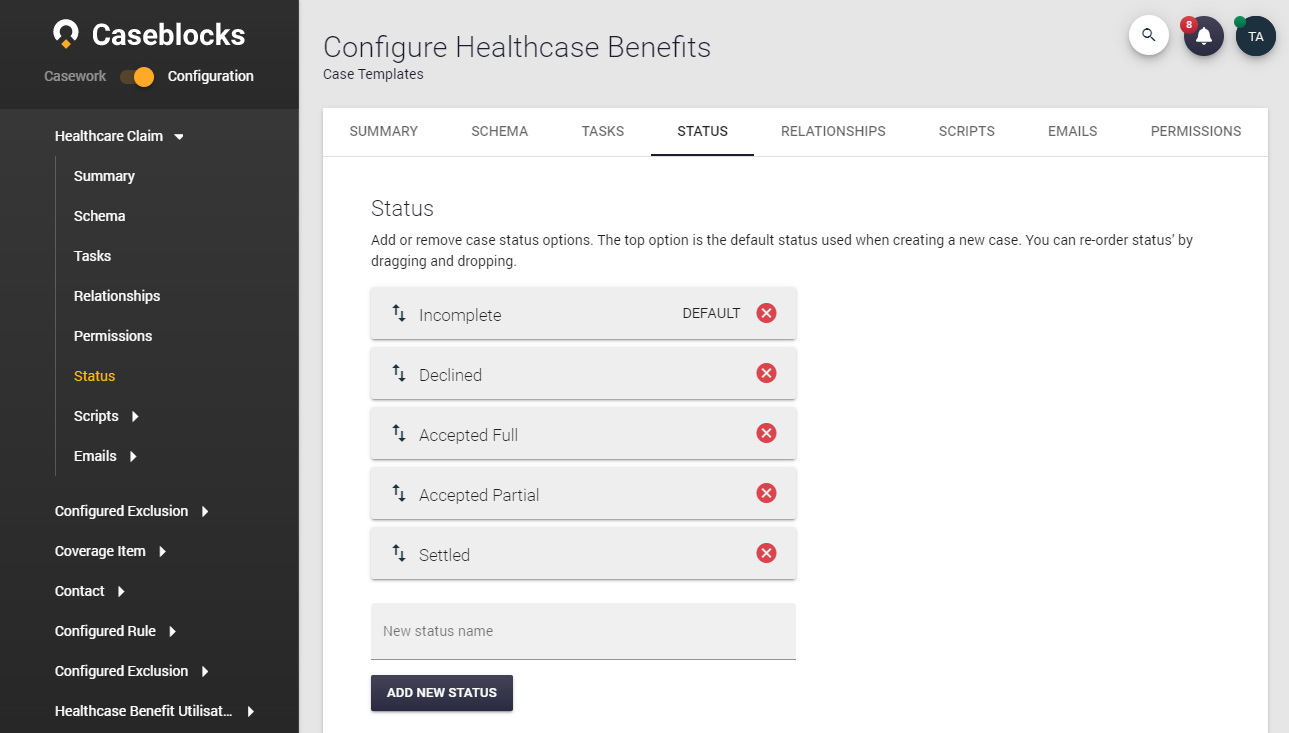

Intelligent rules engine for automated decision making

At the heart of the claims platform is a configurable rules engine which drives automation in the claims process. Claims assessment rules vary in complexity and scale depending on line of business, product, claim type and customer. With Caseblocks the assessment rules are built into the adjudication engine for automated assessing. Caseblocks uses an intelligent rules engine tomake all ‘accept’, ‘reject’ and ‘refer’ and ‘adjust’ decisions.

This means claims can be processed in seconds and paid out in real-time. If you are moving from manual processes, Caseblocks can target 80% straight through processing as a first milestone. The system includes authorisation workflows, allowing claims to proceed direct to settlement or await authorisation depending on controls set.

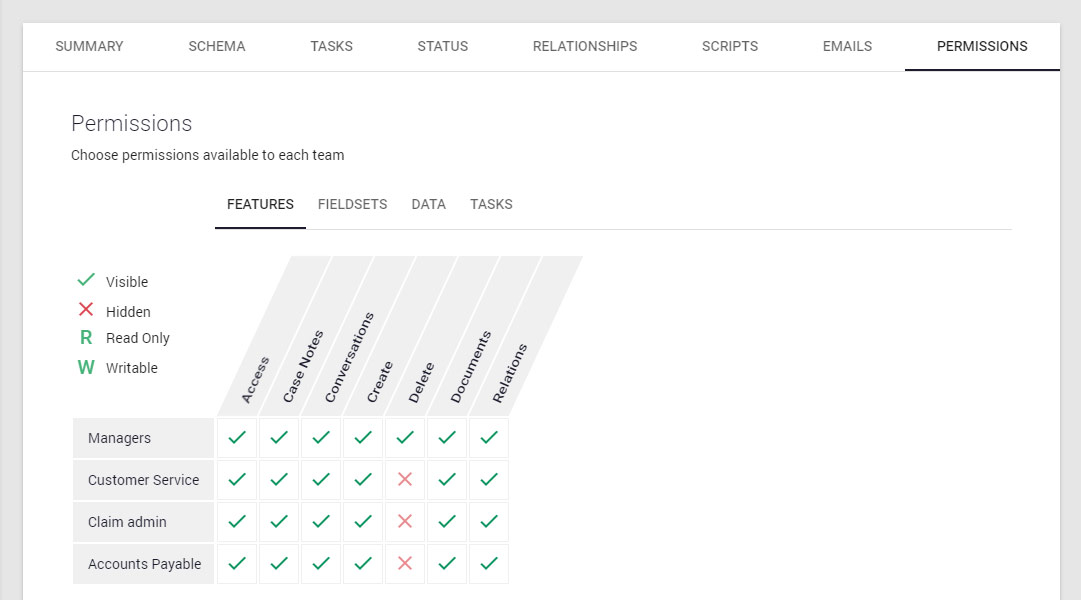

Business led configuration to differentiate your claims experience

We recognise that each insurer provides customers with a unique experience when it comes to handling claims. Caseblocks gives you the freedom to create your own differentiated claims experience with tools for business-led configuration, technical customisation and integration into your existing policy systems.

Caseblocks’ philosophy is that technology serves the business user, a principle you’ll see applied throughout the new UI. Business users can start processing claims straight away using a range of ready made templates designed for specific business lines. Or, with the click of a button, technical users can access the tools to easily customise the template to suit business requirements of each product.

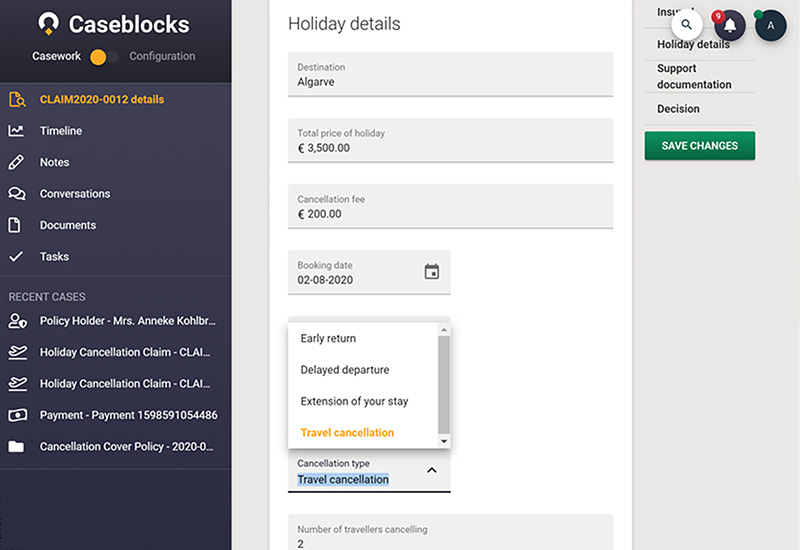

UX designed to speed up claims processing

The look and feel of the Caseblocks system has been updated with new visual components, fonts and styles. It’s not just about how friendly it is, our usability experts have designed the user interface to make it easier and more efficient to navigate the system. For example new fonts draw the eye to important information and button colours highlight the next steps a user should take to advance their workflow.

We’ve moved the menu to the side of the page to simplify the navigation process. Every user has their own ‘My Workspace’ with quick links to their activity Timeline, Notifications and Jobs. It easier than ever to find essential information about each claim.

The benefits are simple, but important. We spent a lot of time reducing the number of clicks it takes our users to find work. Reducing button clicks over large teams translates into time, efficiency, and cost saving benefits.

For consistency we’ve rolled the new font, style and colours into a new logo and website. The launch of the new UI and website marks a key point in Caseblocks strategy to deliver claims automation for insurers as a principal focus.

All of these enhancements are available to Caseblocks users. New Caseblocks users will land on the new interface upon logging in.

Create a robust digital claims process from FNoL to settlement

Caseblocks platform is an accelerator. The newly released templates and configuration tools will help you customise, integrate and automate your claim process without the timescale and effort typically associated with claims transformation projects. Our approach is to target your immediate need. A solid plan and targeted implementation allows you to build resilience relatively quickly with faster returns – measurable in weeks and months, not years.

For more information please click here.