Higher returns with digital claims processing

The need to adopt new technology for the General Insurer (or, Property & Casualty) has been highlighted by Covid-19. Fewer face-to-face interactions, remote damage assessment and remote working must be factored into the claims process.

Caseblocks’ digital end-to-end claims platform enable claims professionals to work remotely and collaboratively with underwriting and actuarial teams. Investing in digital claims transformation goes beyond the benefits of remote working. It is a differentiator in General Insurance. Digital claims support faster, more consistent decision making, resulting in less leakage and potentially higher returns.

Claims transformation

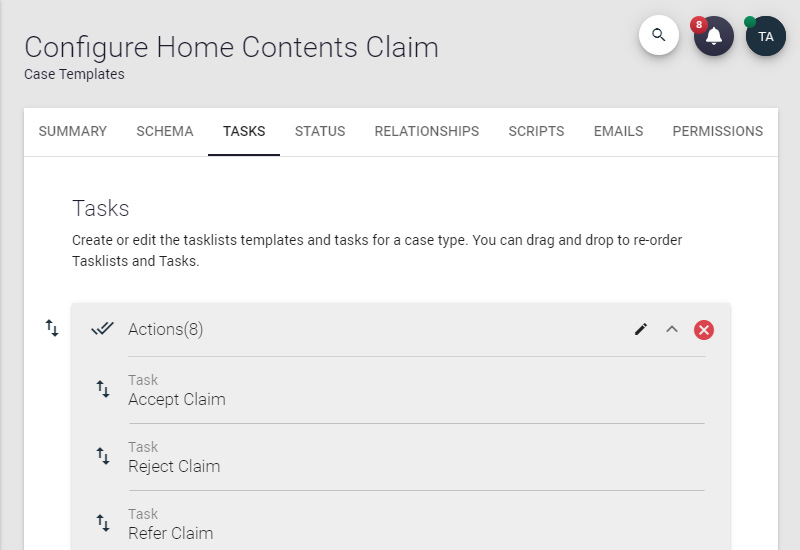

The Caseblocks platform comes with claims templates, standard processes and a configurable rules engine to help you quickly transform and streamline your general claims processes – from first notification of loss through claim capture, assessment, settlement, reversals and recovery. Each insurer has a different approach to handline claims, so the platform comes with tools for business-led configuration, technical customisation and integration into your existing policy systems.

Benefits

- Freedom to create your own differentiated claims experience.

- Reductions in turnaround time and cost per claim through efficient processes.

- High levels of straight through processing through automation and integration.

- Support for remote workers.

- Reduced training time on an easy to use single front end.

General Insurance Types

- Car

- Employer's Liailibty

- Fire & Flooding

- Travel

- Contents

- Buildings

- Yacht

Claims features

- Preloaded claim templates for different business lines & claim types

- Standard claims processes from capture through to settlement

- GraphQL API for easy integration to in-house systems and websites

- Configurable claims rules for automatic assessing

- Referred claim handling

- Scripting environment for detailed business logic and integration

- Configurable service levels for each stage in the process

- Integrated email with automated inbound routing

- Policy and Product Configuration

- Automated payment runs

- Rich media handling for video, images, documents and audio

- Network management

- Cloud or on-premise