Caseblocks Sentiment Score shortlisted for Cover Magazine Innovation Awards

We are delighted to announce that Caseblocks has been shortlisted in the upcoming Cover Magazine Awards 2021. Caseblocks has been selected as a finalist in the Outstanding Innovation of the Year Category for the recently launched Claim Sentiment Score on the Caseblocks claims platform.

Ijonas Kisselbach, Caseblocks CTO said,

“We’re delighted to be a finalist in the COVER Magazine inaugural awards for the Claims Sentiment Score. This innovation is an integrated enhancement to the Caseblocks Healthcare Accelerator and is now available to all front-line claims handlers using our platform. Our goal was to elevate insurers’ ability to respond to customers during the claims process. This recognition of the Claims Sentiment Score and how it enhances customer communications is a credit to the talented team at Caseblocks.”

Elevating the customer claims experience

Claim Sentiment Score is a new feature that blends machine learning and sentiment analysis into Caseblocks’ proprietary claims technology, the Caseblocks Healthcare Accelerator (CHA). Fully integrated into the communication module, it allows claims handler to assess the mood of customers during the claims process, thus elevating their ability to prioritise vulnerable customer cases and respond appropriately, fairly and in a timely manner.

Why use a sentiment score in healthcare claims?

The crucial, acid test for an insurer is how it deals with a customer’s claim. Insurance companies deal with vulnerability inconsistently even within their own internal departments. Customers making healthcare claims are particularly vulnerable, for example they may be having treatment for cancer, an injury or another ailment which creates additional stress and vulnerabilities.¹

Clearly, making a healthcare claim for many people is a highly stressful, inconvenient, and upsetting time. The sentiment score launched during the pandemic, when the coronavirus and lockdown measures have increased the number and severity of issues affecting consumers (for example ill health, bereavement and job loss).² Now more than ever, this feature has been designed to help insurers pay greater attention to the needs of their customers, the policy holders.

The sentiment score goes beyond producing high level KPI metrics. It is fully integrated into the claims processing workflow making it a useful and important tool for front-line claims handlers to improve the claims experience for customers.

Sentiment Score for Emails

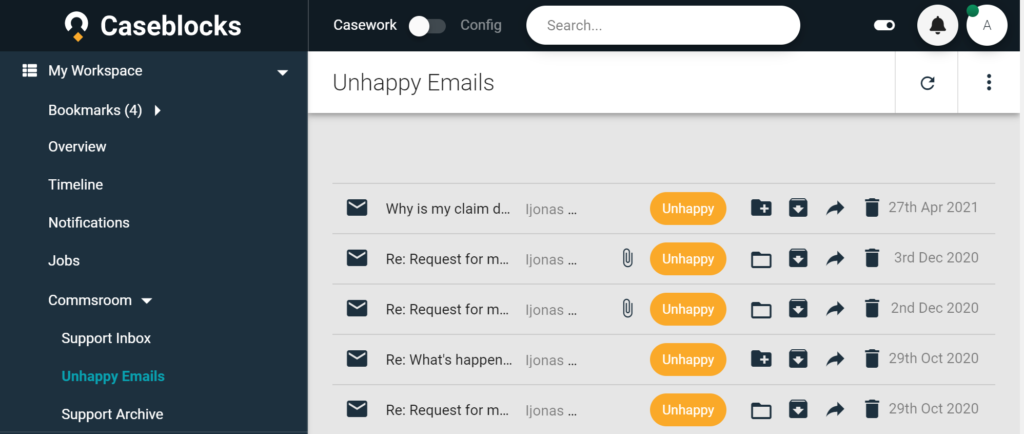

The image below highlights the claims case handler’s view of the email sentiment score.

Case handlers can see unhappy emails at a glance in the Commsroom. The sentiment score is integrated into Caseblock’s email modules for automatic customer sentiment scoring. Emails are scored used the machine learning tool and those deemed unhappy are automatically filtered into the ‘unhappy emails’ filter in the Commsroom.

Healthcare insurers can use the sentiment score in work queue filtering and as a visual cue for caseworkers responding to both individual customer emails as well as the entire ‘case’ or ‘claim’.

Sentiment Score for Claims

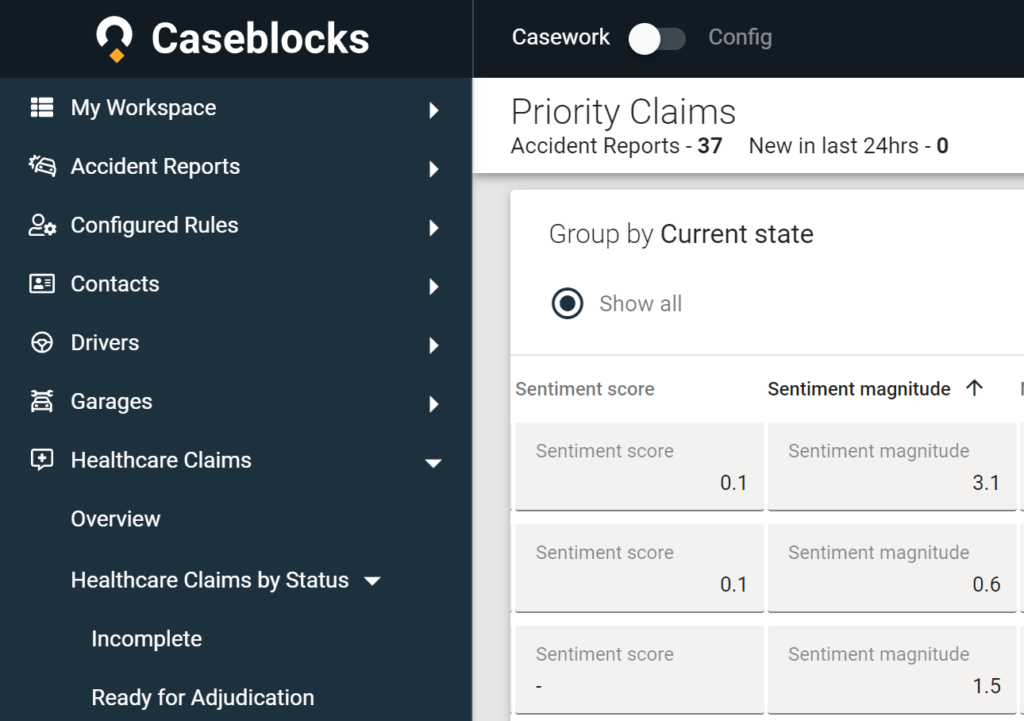

The image below shows the view of priority claims, allowing claims handlers to prioritise case workload by sentiment score and sentiment magnitude for claims as a whole, rather than individual emails.

All email communications relating to a claim are analysed for sentiment and prioritised by sentiment score, then magnitude is measured based on the volume of sentiment from all emails involved in a claims case.

Improving the claims experience

Email sentiment analysis helps healthcare insurers engage more effectively to improve communications when it matters most, when making a claim. It does this by analysing customer communications and providing a sentiment score to better filter and provide more personalised email communications. Benefits include:

→ Improved customer response times

→ Reduced delays in communication to vulnerable customers

→ Integrated email for simplified customer communications

→ Filtering claims for targeted support such as vulnerable customers

→ Gives claims handler simple and powerful tools to interact with referred claims

Integrated into claims workflow for every customer

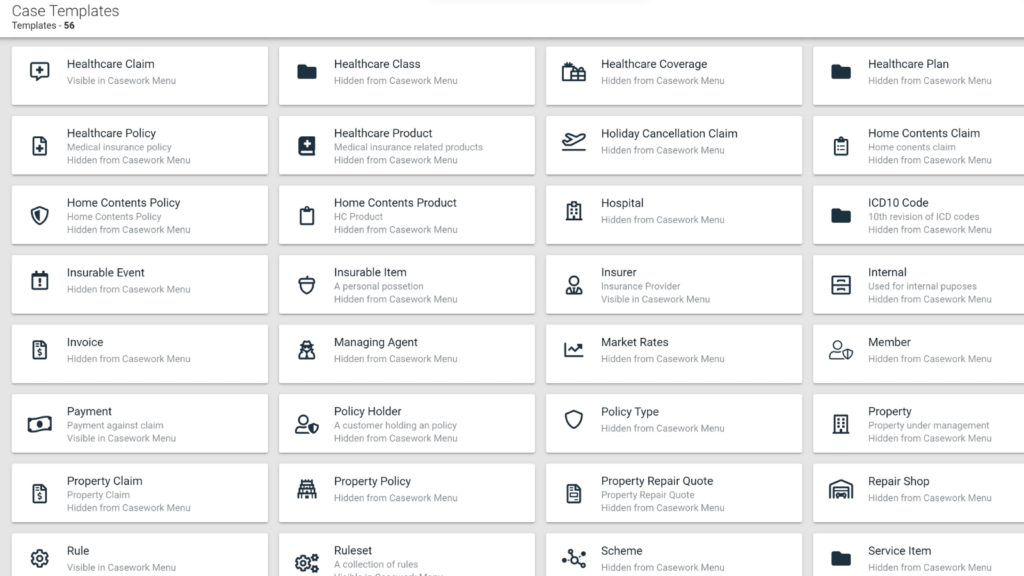

The sentiment scoring features now comes as standard in the Caseblocks Healthcare Accelerator (CHA). As the automation backbone of a claims process, the CHA combines configurable case templates to allow healthcare insurers to customise the platform to their unique workflow.

About Caseblocks

Caseblocks provides a unified claims platform capable of handling claims across Life, Health and General business lines, integrated to multiple policy administration systems. As part of a digital healthcare claims solution the automation platform enables automated claims adjudication to improve the customer claims experience and drive gains in; claim turnaround time, straight through processing rates, benefit containment and claims decision transparency for the healthcare customer. If you would like more information please request the product sheet for the Claims Healthcare Accelerator here.

About the awards

The awards will be presented in conjunction with the inaugural COVER Health Insurance Live event on the 30th of June. The Recognising Healthcare Innovation awards celebrate the best the heath insurance industry has to offer and the winner will be selected by a distinguished judging panel across the field of healthcare insurance.

Footnotes:

¹ Chartered Institute of Insurance (CII) Customer Vulnerability – How well is insurance responding? 2017

² FCA, GC20/3, Guidance for firms on the fair treatment of vulnerable customers, July 2020